More reach. More engagement.

Your brand deserves more

If you want to reach a large number of people with your brand, TV guides are the ideal medium. This is because 41.1% of German adults read them, making TV guides the largest print segment in Germany. These publications are read particularly intensively and are consulted nine times a week.

Seeking out experiences

A usage situation that’s ideal for brands

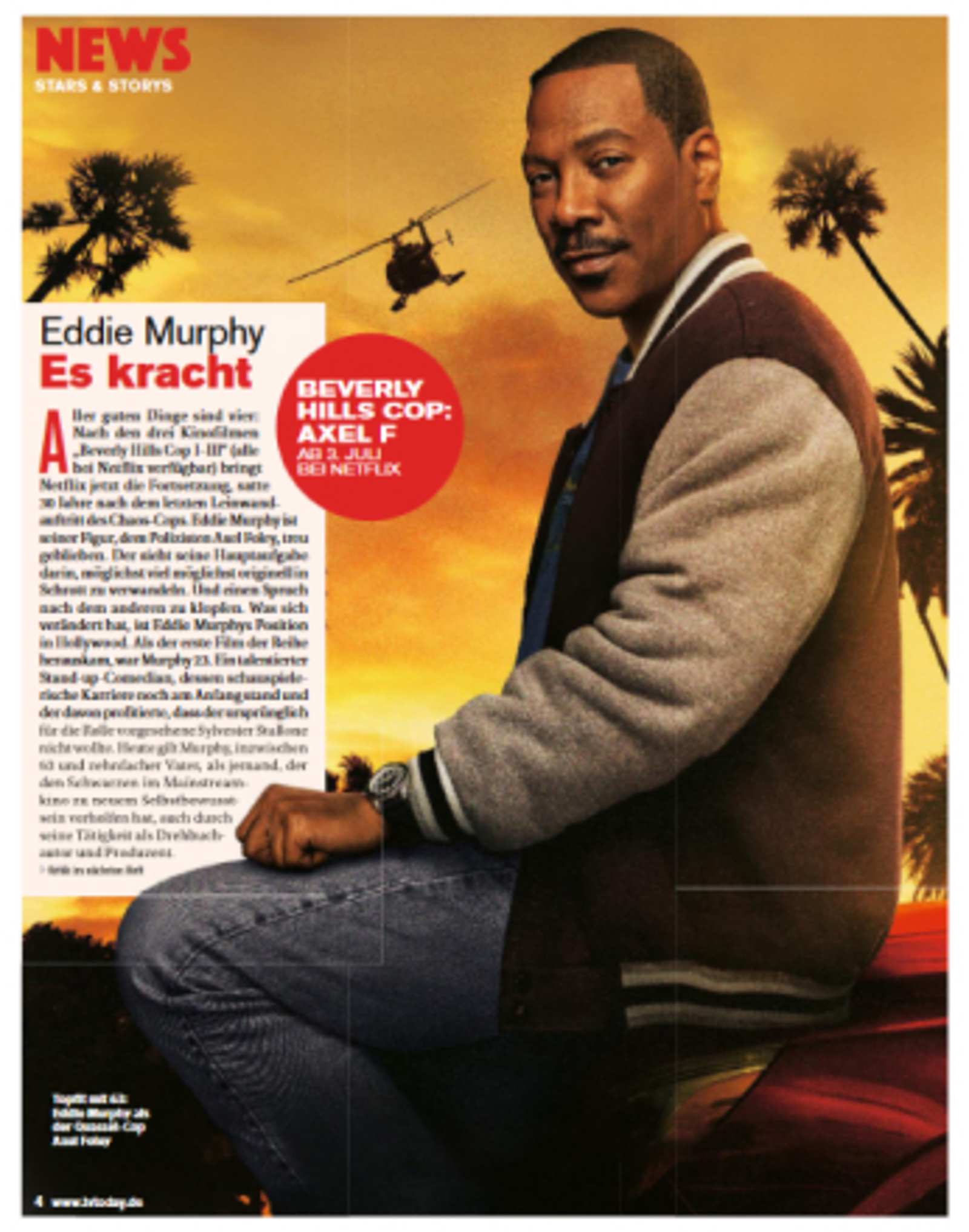

Anyone who picks up a TV guide is looking to experience something and hopes to find inspiration. Readers immerse themselves in a world full of entertainment, stories, stars, and celebrities. Wouldn’t you like your brand to become an experience, too?

30 million people in Germany read TV guides. No other magazine segment has anywhere near as many readers. And such interesting ones, too. An audience that’s massive, yet classy.

9 million copies are sold per issue. This makes TV guides the best-selling magazine segment in Germany. High circulation for strong brands.

71 percent of readers are so loyal to their brand that they stick with one TV guide. For advertisers, this means hardly any overlap – booking multiple titles boosts readership efficiently.

9 times a week: On average, each TV guide is picked up more than once a day. And 80% of readers use their magazine even before the program starts. Frequent use creates strong effects.

2.3 times: On average, every ad in TV guides is seen 2.3 times. That’s more than twice the impact for your advertisement.

96 percent also read the pages before and after the program section – the whole magazine is used. Health, travel, food, mobility... TV guides are multitalented in terms of topics. Versatile environments for each advertiser.

60 percent of readers also use their TV guide to find out about streaming content in media libraries. This is how to reach streamers.

550 million euros annually – that’s what German consumers spend on TV guides. Proof of how much they appreciate the medium. A must-have in every household, a must-have for every brand.

Showcasing brands with the TV guides from BCN

Book your brand experience

BCN markets 20 TV guides – more than any other marketer – reaching 21.2% of Germany’s total population and 23.4% more people than our strongest competitor. We thus cover a comprehensive spectrum of TV guides, offering your brand the right environment in which to be the star.

BCN TV Booster

TV Spielfilm, TV Today, TV DIGITAL, TVdirekt

Reach

- More: 8.05 million readers

vs. 6.58 million at the largest competitor

Target group

- Wealthier: net household income € 3,850

vs. € 3,537 at the largest competitor - Younger: average age 48.2

2.2 years younger than at the largest competitor - Higher brand affinity: 36.5% brand fans

vs. 29.0% at the largest competitor

Performance

- More efficient: € 15.80 CPM

vs. € 18.02 at the largest competitor - Cheaper: € 62.86 TAP

vs. € 65.08 at the largest competitor

BCN TV Booster WEEKLY

HÖRZU, Gong, BILD + FUNK, Bildwoche, Die 2, Funk Uhr, Super TV, TV neu

Reach

- More: 6.33 million readers

vs. 4.89 million at the largest competitor

Target group

- Wealthier: net household income € 3,068

vs. € 2,852 at the largest competitor - Younger: average age 64.5

1.2 years younger than at the largest competitor - Higher brand affinity: 50.8% brand fans

vs. 46.4% at the largest competitor

Performance

- More efficient: € 20.20 CPM

vs. € 23.73 at the largest competitor - Cheaper: € 100.53 TAP

vs. € 108.84 at the largest competitor